Business practicalities in China

Operating effectively in China requires awareness of practical considerations. This chapter covers regulations, taxation, customs duties, employment law, banking and other essentials for doing business with confidence.

Laws and regulations

China’s regulatory processes have recently become more structured and compliance oriented. Importers and investors need to be prepared for longer timelines and high precision in compliance submissions.

Land and property rights

All land in China is owned by the Chinese Government or farmers’ collectives. Long-term land leases can only be issued by the government to businesses or individuals, including foreigners. However, these are subject to restrictions and complicated processes.

Although foreigners cannot own land in China, Australian businesses can gain land use rights through wholly foreign-owned enterprises or joint ventures. But rules can change at short notice. Foreign investors have found their land use rights revoked in the past to facilitate government projects.

To ensure compliance and mitigate risks, Australian investors must perform thorough due diligence with respect to property leasing in China.

Cybersecurity

China’s cybersecurity and information technology initiatives are governed by the Cybersecurity Administration of China (CAC). The CAC is responsible for drafting policies, making legal standards and strategies to ensure the authenticity and security of all infrastructure pertaining to information. Additionally, there are industry-specific bodies that oversee compliance with Chinese cybersecurity laws. These include the Ministry of Industry and Information Technology, which regulates the IT and industrial sectors and the People’s Bank of China, which oversees cybersecurity in the financial sector.

China’s Cybersecurity Law protect critical information infrastructure, data and individual privacy. The law requires companies, including foreign enterprises, to store personal information or data generated in China domestically. Companies that fail to comply can face business suspension, license revocation or penalties of up to CNY 1 million (AUD 213,768).

Australian companies looking to enter China must navigate stringent data protection regulations, and potentially invest in local data centres to ensure compliance with China’s cybersecurity standards.

Intellectual property (IP)

China is party to several international IP treaties, namely the Paris Convention, Berne Convention, Nice Agreement, Hague Agreement, WIPO Convention, the Madrid Protocol, the Patent Cooperation Treaty and the Marrakesh VIP Treaty.

The China National Intellectual Property Administration (CNIPA) oversees approval for patents, trademarks, geographical indications and layout designs of integrated circuits, while the State Administration for Market Regulation (SAMR) manages their enforcement. Despite the regulations in place, IP rules are not always adhered to in China.

Domestic IP registration is necessary to protect IP in China. Because China uses the “first-to-file” principle, Australian companies introducing innovative products into the market should prioritise registering their IP rights in China at the earliest opportunity. Organisations are encouraged to be vigilant and take steps to protect against IP theft and address infringements swiftly.

Violation of IP and enforcement options

Businesses seeking to enforce their IP rights in China have several options depending on the type of dispute. IP recourse can be filed through administrative, civil or criminal enforcement. Businesses can also approach China Customs to seize and destroy goods that infringe on their IP rights. IP disputes in China are heard by the Peoples’ Courts, as well as the country’s four specialised IP Courts and IP tribunals.

Businesses should ensure they maintain all documents regarding their IP rights and consult expert IP counsel in China. Businesses can also consult IP Australia for advice.

Customs duties

Import duties and tariffs

China has been a World Trade Organization member since 2001. It imposes Most-Favoured-Nation (MFN) import tariffs on good and services from other WTO members. These rates vary by product. In 2024, the simple average MFN tariff rate for imports was 7.5 per cent, 14 per cent for agricultural products and 6.4 per cent for non-agricultural products. In 2024, China reduced import duties on goods such as medical products, critical equipment, resources and some agricultural products.

Australian exports to China qualify for preferential rates under the China-Australia Free Trade Agreement (ChAFTA) and the Regional Comprehensive Economic Partnership (RCEP). ChAFTA benefits Australian agricultural goods exporters through the reduction, or elimination, of tariffs on seafood, lamb, horticulture, dairy, beef, wine and wool. Similarly, by 2029, almost all resources, energy and manufacturing exports to China will enter the country duty-free.

Registration with the China Import Food Enterprise Registration (CIFER) system is mandatory for Australian businesses exporting food products to China. The General Administration of Customs of the People’s Republic of China (GACC) oversees CIFER and Chinese authorities evaluate every application.

To find the tariff rate for specific goods from Australia, visit the Department of Foreign Affairs and Trade’s FTA portal at ftaportal.dfat.gov.au and DFAT’s guide on using ChAFTA for technical market access information for agricultural products.

Calculations and payments

China follows the WTO Valuation Agreement on imported goods. Import duty is calculated by multiplying the imported good’s dutiable value by the corresponding import duty rate. The dutiable value of imported goods is typically based on the cost, insurance and freight level under the International Commercial Terms. Import duty in China is charged based on customs valuation of the goods.

Other taxes and charges

VAT is applied to all imports into China, at a standard rate of 13 per cent for most goods, and a reduced rate of 9 per cent for necessities such as agricultural products and utilities.

China also imposes a consumption tax on imports considered harmful such as tobacco or alcohol, automobiles and luxury goods including jewellery and cosmetics products.

All duties and taxes are paid on goods valued at more than CNY 300 (AUD 64).

The payment of customs duty, import VAT and consumption tax can be exempted in the case of raw material imports on the part of the raw materials that are re-exported after processing.

Export duties

In 2024, China imposed export tariffs on 107 products. Of these, interim duty rates are applicable to most, which means the duty is lower on these products that the usual tariffs levied on their exports.

Import and export regulations

China uses an automatic import licensing system to regulate imports for mechanical and electronic products. Importers of these products must obtain an Automatic Import Licence from the Ministry of Commerce (MOFCOM) before completing customs procedures.

China prohibits the import of arms, counterfeit currencies, harmful media, poisons, illicit drugs, diseased animals and plants, local currency and harmful food items. It also restricts the import of commodities related to the processing trade, including used garments, licentious publications, industrial waste and junk.

In most cases, when exporting to China, the importer puts together the documents required to import goods. The documents required vary by product, but typically include a commercial invoice, bill of lading, shipping list, packing list, customs declaration, insurance policy and sales contract. Some products also require import quota certificates, import licenses, inspection certificates or safety licenses.

More information on import and export regulations can be found at english.customs.gov.cn

Taxation

The State Taxation Administration (STA) is responsible for tax collection and enforcement of state revenue laws in China. Its functions include drafting tax laws and regulations, formulating tax and economic policies as well as tax collection. China is taking steps to make its tax system more transparent for businesses.

This section provides an overview of the taxes Australian businesses must consider while operating in China. Not all applicable taxes are covered in this guide and the information provided is of a general nature. Businesses should seek professional tax advice for understanding the taxes specific to their activities.

Table 1: Overview of China’s taxes for businesses

Corporate Income Tax (CIT)

Under the CIT law, the standard tax rate in China is 25 per cent for both resident as well as non-resident companies if they generate income within China. CIT is settled annually but typically paid quarterly.

However, there are exceptions and companies engaged in certain activities qualify for lower rates. For example, a reduced CIT rate of 15 per cent can be enjoyed by new and high-tech enterprises as well as pollution control and prevention firms. Key software and integrated circuit design companies are charged 10 per cent CIT after a five-year CIT exemption. Technologyadvanced service enterprises can benefit from a 15 per cent CIT rate as well. Meanwhile, small enterprises with an annual taxable income below CNY 3 million (AUD 641,574) pay only 5 per cent CIT to the end of 2027.

Personal income tax

Residents in China are subject to individual income tax (IIT) on their worldwide income, while nonresidents are taxed only on income generated in China. Individuals who have resided in China for 183 days or more in a year are considered Chinese tax residents. However, according to a rule change in 2024, a non-resident pays tax on their Chinese income if they have been outside of the country for 183 days each year for the past six years, or if they have left China for more than 30 days in a single trip.

China employs a progressive tax system and assesses income on a monthly basis. The highest tax rate payable for residents and non-residents is 45 per cent. For both residents and non-residents, a deduction is permitted, see the table below.

Australia has a double taxation agreement (DTA) with China. Individuals are advised to seek advice from a professional with knowledge of tax law in China and Australia to ensure compliance with the DTA. The tax payable by residents is calculated using the following formula:

(Annual taxable income x Tax rate) - Quick deduction

Individual tax rates – Employment income (for residents)

The tax payable by non-residents is calculated using the following formula:

(Monthly taxable income x Tax rate) - Quick deduction

Individual tax rates – Employment income (for non-residents)

Individuals who earn an income from privately owned businesses, sole proprietorship enterprises or partnerships are usually subject to IIT at progressive rates ranging from 5 to 35 per cent.

Individual tax rates – Business income from privately-owned businesses, sole proprietorship enterprises or partnerships

China also imposes a flat IIT rate of 20 per cent on other kinds of income including incidental income, interest income, dividends, capital gains and rental income.

Indirect taxes

Value Added Tax: VAT applies to businesses and individuals involved in the sale of services, intangible assets or immovable property within China. VAT rates range from 6 to 13 per cent on the newly created value throughout various stages of production, distribution and services, targeting the added value of a product.

Consumption Tax: Organisations and individuals that manufacture, subcontract or import certain goods into mainland China pay a consumption tax. The consumption tax rates are calculated based on the value of the transaction. These goods include tobacco, alcohol, cosmetics, precious jewellery and stones, firecrackers, processed oil, automobile tires, motorcycles, motor vehicles, golf equipment and facilities, luxury watches, yachts, disposable wooden chopsticks and wooden flooring.

Audit and accountancy

Auditing and accountancy play a vital role in enhancing transparency and accountability in a business, especially one engaged in a foreign market. It increases business performance by identifying risks and highlighting areas for improvement.

Accounting standards

China’s accounting rules are known as the Chinese Accounting Standards (CAS). While the CAS has moved toward aligning with the International Financial Reporting Standards (IFRS), differences in implementation and interpretation remain. CAS comprises the Accounting Standards for Business Enterprises (ASBEs), which most foreign enterprises also follow, and the Accounting Standards for Small Business Enterprises (ASSBEs).

In ledgers and financial reports, the CNY is the base currency. Companies that use other currencies in business can use those foreign currencies as the functional currency, but will need to present their financial reports in the local currency. Similarly, all accounting records must be maintained in Chinese.

Australian businesses operations in China should review the differences between the two jurisdictions to ensure their records are compliant with both countries’ accounting requirements.

Statutory audits

In China, all foreign-invested enterprises must prepare complete annual statements for an annual statutory audit. These audits are conducted by Certified Public Accountants (CPAs) registered in China. The CPAs follow the Chinese Independent Auditing Standards (CIAS) set by the Chinese Institute of Certified Public Accountants (CICPA) in performing the statutory audit. For accounting purposes, there are no major differences between the accounting standards for domestic and foreign enterprises.

Overseas repatriation of profits and dividends is permitted once audited financial statements have been filed and tax liabilities settled.

Books and records

In China, all financial reports and ledgers must be maintained in RMB (CNY). Accounting records must be maintained in Chinese, but foreign companies have the option to use a combination of Chinese and another language for their records.

The fiscal year in China runs from January 1 to December 31, and annual corporate income tax must be filed by 31 May. Businesses in China must preserve their books and records for at least 10 years.

Quality control

The Accounting Regulatory Department, which is part of the Ministry of Finance of China, sets accounting standards for businesses in China.

While foreign companies can reconcile their CIT up to May 31 every year, compliance investigations by the tax bureau could continue until the end of the year.

There are no members from China in the International Forum of Independent Audit Regulators (IFIAR).

Employing workers

Doing business in China will often require employing local and foreign workers. Understanding China’s labour market regulations, recruitment methods and country-specific management styles is crucial to building and supporting an effective team. Employing workers in China is now highly regulated and and compliance oriented.

Labour market

Skill level: China has 200 million skilled workers, of whom 60 million are considered highly skilled, accounting for over a quarter of its workforce. In 2024, China’s labour force participation rate was 65 per cent, and unemployment remains relatively constant at 5.2 per cent. Youth unemployment stands at 17.7 per cent in October 2025 and remains a policy concern. China’s labour market suffers a mismatch as with employers struggling to recruit skilled workers while many young graduates are unable to find jobs.

To increase the skill level across its population, the country is investing in modern vocational training systems, as well as science, technology, engineering and mathematics education to pivot toward high-tech industrial growth.

Forced labour and the prevalence of unsafe working conditions remains a concern in China. Workers often work long hours at very low wages and have little or no recourse to voice their concerns.

Employment contracts: The Contract Law (2008) and the Labor Law (1994) govern laws around employment in China. Employment contracts must be provided to employees within one month of hiring and be written in Chinese.

There are three types of labour contracts in China:

Minimum wage: The minimum wage system in China is governed by the Provisions on Minimum Wage regulations and differs by province. Monthly minimum wage is applied to full-time employees, while hourly minimum wage is applied to non-full-time employees. Minimum wages exclude benefits such as overtime payments and other allowances.

Table 2: Minimum wages across Chinese provinces. To access the table, visit this link and navigate to Page 36 of the Doing Business Guide.

Human resources and employment law: Several laws govern employment relationships in China – Labour Law, Employment Contract Law, Implementing Regulations and the Social Security Law. Australian businesses need to adhere to provincial or municipal level rules, regulations and practices when doing business in China. Foreign businesses need to be mindful that regulations regarding wages, working hours and leave provisions vary by province.

Working hours: A standard working week consists of no more than 44 hours with 8-hour shifts per day.

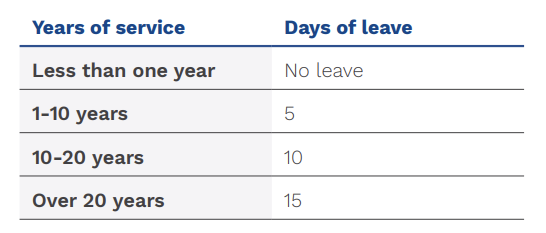

Holidays: Statutory paid annual leave is regulated through the Regulations on Paid Annual Leave of Employees. Employees in China are also entitled to additional leave such as rest days, public holidays and maternity and paternity leave. It is customary for employees to receive 13th month pay before Chinese New Year.

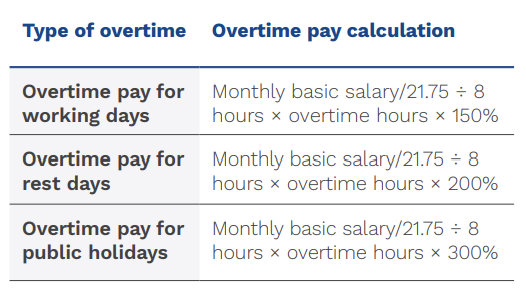

Overtime: China’s Labour Law governs the framework related to overtime payments for employees. Employees have the right to safeguard their entitlements regarding overtime payments. Any employee working for more than 8 hours per day or 40 hours per week is entitled to overtime payments, calculated using the following formula:

Sick leave: Specific types of sick leaves with recuperation periods are subject to regulations. Employees can receive between 60 per cent to 100 per cent of their regular wages when on sick leave. For those who have been in employment for less than five years with their current company and employed for less than 10 years overall, a minimum of three months of sick leave is permitted. Meanwhile, employees who have more than 20 years of work experience, with 15 years at their current employer are entitled to unlimited paid sick leave. Employers are legally bound to pay a part of an employee’s salary during the recuperation period.

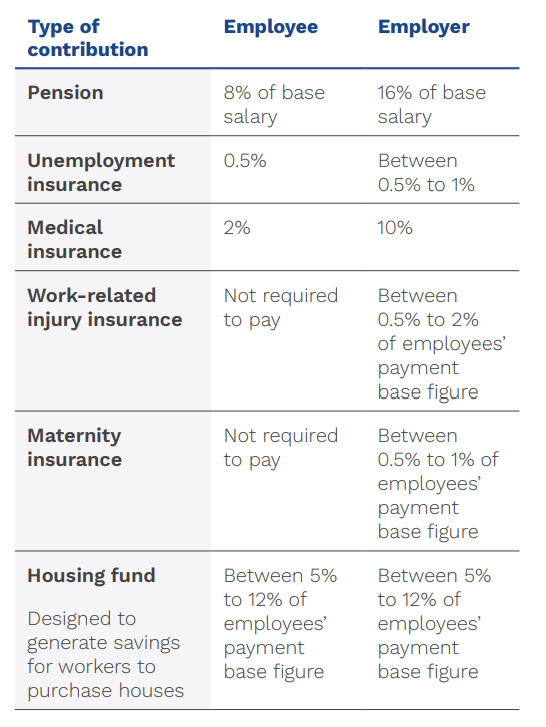

Social, health and unemployment insurance contributions: China’s social security system features several types of insurance managed at the regional level. Premiums paid to the social insurance system are collected by tax authorities. It is mandatory for employers to register new employees for social insurance contribution within 30 days of their appointment. Foreign employees from countries with social insurance exemption agreements with China are eligible for exemptions, although Australia is not one of these countries.

Social security contributions are determined by calculating the average income of an employee in the previous year, multiplied by the type of social insurance being paid. There are six types of social insurance:

- Pension insurance

- Unemployment insurance

- Medical insurance

- Work-related injury insurance

- Maternity insurance

- Housing fund

The share of contribution rates paid by employers and employees are listed below:

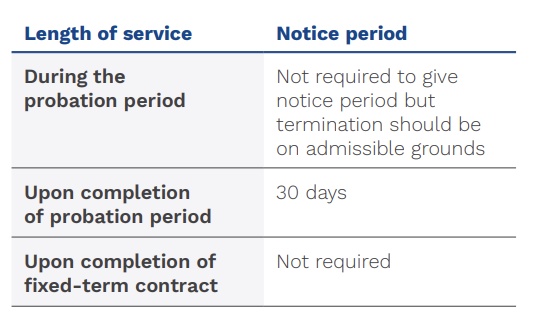

Ending employment: Rules regarding employee termination are governed by the Chinese Labour Contract Law. Employers are required to provide notice periods before terminating an employee.

Employees experiencing occupational injury or disease, on maternity leave, under treatment for non-work-related injury or illness, and employees less than five years away from their retirement cannot be terminated by employers.

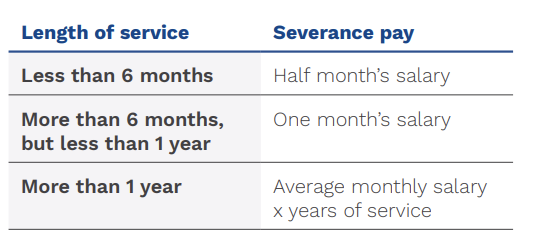

Severance pay: When terminating an employee on mutual grounds or upon bankruptcy or upon mass layoffs, employers are required to make severance payments. Severance pay is calculated based on the average monthly salary and the years of service an employee has worked with the company.

Recruiting staff

Online advertising: Advertising in national job portals, utilising social media and professional networks are effective ways to access talent in China, and many companies recruit online to increase the likelihood of getting skilled workers. Major job portals include:

- Zhaopin - Wide market reach with substantial database of users.

- 51Job - Provides access to a large user base and a variety of recruitment services.

- Liepin - Leverages AI and data analytics for higher-level recruitment.

- Boss Zhipin - Among the largest recruitment platforms with a substantial database of users.

- WeChat - Wide user base providing recruitment services.

Executive search: For a more tailored search, particularly for senior executives or individuals with technical skills, a recruitment or executive search firm can prove helpful. International firms such as Michael Page, Korn Ferry, Antal International and Hays Specialist Recruitment have offices in China, among others.

Work permits: An employer and employee must fulfil several criteria to qualify for a Chinese work permit. Foreign workers can be recruited for necessary roles where domestic workers are unable to meet requirements. Employees must meet employment eligibility and should be above the legal age to work and possess the required skills.

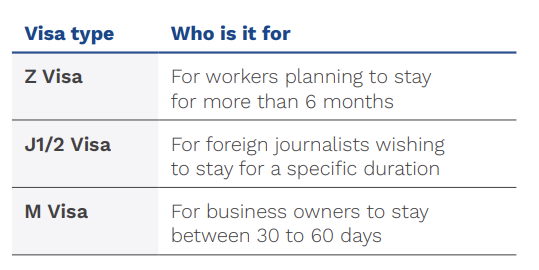

Work permits are categorised into three categories – A, B and C. Among the three, visa for the “A” category applicants are approved faster than others. China has provided visa-free entry to Australian passport holders, enabling Australians to travel to China for business purposes without having to go through visa application. Other types of Chinese visas accorded to foreign workers are:

Banking in China

A foreign-invested enterprise (FIE) in China must have at least two bank accounts. One is a basic RMB account for daily business operations and is the only account from which CNY cash transactions can be made. The other is a foreign currency capital account, which is used to receive funds from outside the country. Permission to open a foreign currency capital account is required from the State Administration of Foreign Exchange (SAFE).

Other types of foreign currency accounts that can be set up are settlement accounts, foreign debt special accounts and temporary capital accounts.

For non-resident companies in China, opening a bank account is strictly regulated. An account must be opened in person and requires significant documentation, the company’s and its legal representative’s official stamp and approval from State Administration of Foreign Exchange (SAFE). Foreign companies can open NRA (Non-Resident Account) CNY accounts with Chinese banks or NRA CNH accounts with overseas banks without approval of People’s Bank of China (PBOC).Companies need to provide evidence of business registration in China such as a business license, tax registration certificates, articles of association, a list of directors’ names, proof of business address or a bank authorisation letter. Additional documents may be required depending on the bank.

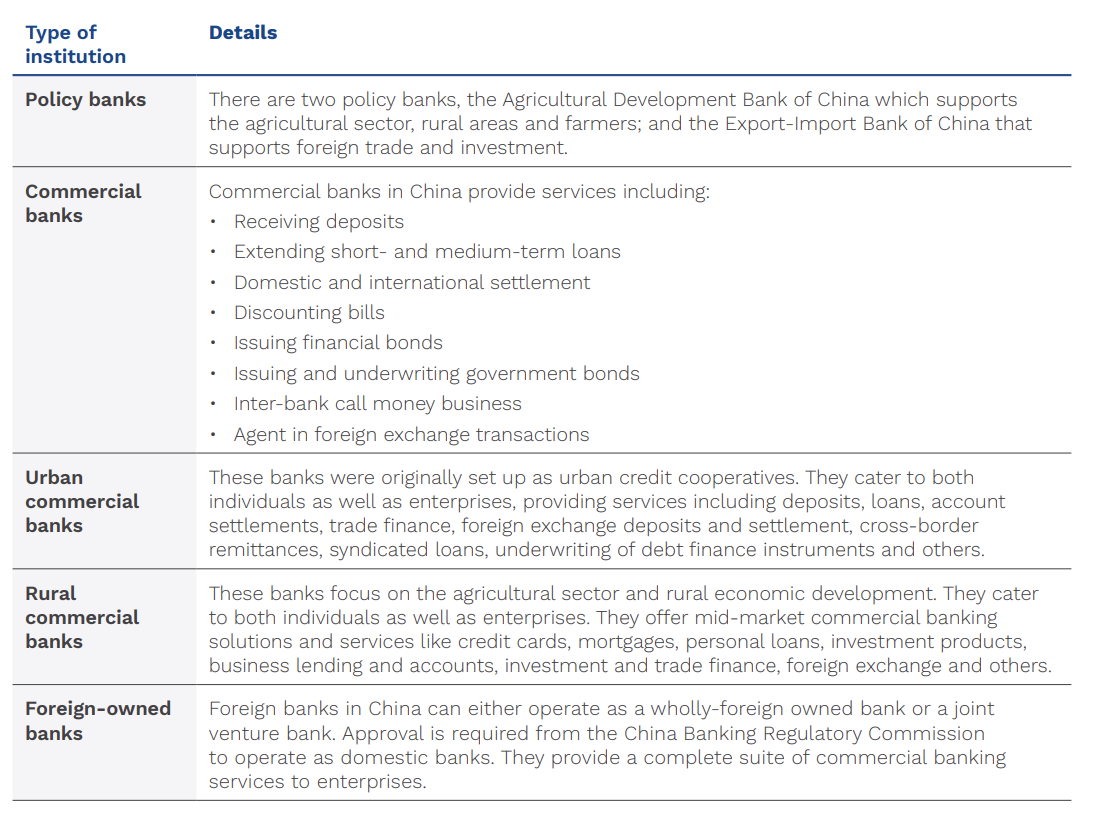

Table 3: Financial institutions in China

Australian banks in China

ANZ, Commonwealth Bank of Australia and National Australia Bank have branches and representative offices in China. Services include institutional banking, retail banking and foreign currency services for individuals, companies and institutional clients.

Foreign exchange controls

China’s foreign exchange regime is regulated and managed by SAFE and the central bank. Exchange rates are decided as per the “managed float system.”

China has a strict foreign exchange control regime and a closed capital account. Companies must adhere to foreign exchange guidelines to move money into or out of the country, including approval from SAFE. The system is being liberalised gradually as the government trials looser controls in free trade zones and in economic nodes such as the Greater Bay Area. Chinese regulators are also considering the relaxation of foreign exchange rules for foreign companies, such as allowing cross-border lending in the local currency and cross-border sweep of local and foreign currencies.

The repatriation of profits out of China is complex. It can be done by paying dividends to shareholders provided the company has conducted an annual external audit, has paid all taxes and maintains a minimum of 50 per cent of the company’s registered capital as after-tax profits. Alternatively, profits can be transferred as expenses or royalties to an overseas parent company, but these transfers are inspected thoroughly in China.

Australian businesses should engage regularly with their local banking partner in China to stay abreast of changes in the foreign exchange regime.