How to enter the Chinese market

A well-planned entry strategy is essential for success in China. This chapter explores market entry pathways, business structures and localisation strategies for Australian exporters and investors.

Exporting to China

China is Australia’s top export market. As of 2023-24, Australian exports of goods and services to China made up 32.2 per cent of Australia’s total exports. China is also Australia’s largest trading partner, with two-way trade in goods and services cumulatively valued at AUD 325.5 billion in 2023-24. Iron ore, natural gas, crude minerals dominate Australian exports, but other sectors offer promising opportunities, including food and agribusiness, healthcare, the green economy, technology and METS.

Market entry models for exporting goods and services

Choosing an appropriate market entry model is essential for businesses looking to export to China. Any choice should be informed by factors such as the overarching business strategy, target sector, and business size and maturity. Market entry models frequently evolve over time.

A. Direct exporting

In direct exporting, businesses sell directly to a Chinese customer from Australia. Exporting directly to China requires a significant level of involvement in the export process, including market research, marketing, distribution, sales, product registration and approval, import-export licencing and receivables.

Businesses using this model may need to consider employing an agent or distributor to handle local product registrations, while still maintaining control over other aspects such as marketing and supply chain. Exporting directly to China requires engaging an ‘importer’, a company registered in China with an import and export licence to facilitate the entry and payment of goods.

Another direct export strategy is to establish a foreign-invested enterprise in China (FIE) most commonly taking the form of a wholly foreign-owned enterprise (WFOE), discussed further in ‘market entry models’ below

Direct exporting has some advantages, including:

- Greater control of commercial processes, including sales

- Better margins, as middlemen are avoided

- More direct customer relationships

This approach will require businesses to engage with customers regularly to build awareness and understanding of the products they are selling on your behalf. In return, their understanding of the Chinese market can be applied to product development, pricing and marketing. Selling directly to local retailers can generally cut commissions, reduce expensive travel and create an effective conduit to market.

B. Agents and distributors

Many Australian firms doing business internationally rely on agents or distributors. The roles of agents and distributors differ, and they can vary across industry. It is therefore critical that roles and responsibilities are clearly defined early in any agreement.

Agents: Agents act as representatives of suppliers and do not take ownership of the products they sell. They are usually paid on a commission basis, which provides an incentive for them to drive sales. Being based in China, they will often represent several complementary products or services. They can be retained exclusively as the sole agent for a company’s goods or services or as one of several for the exporter.

Distributors: Unlike agents, distributors buy the goods from exporters and then resell them to local retailers or directly to consumers. In some cases, a distributor may sell to other wholesalers who then on-sell to retailers or consumers. Distributors may carry complementary and competing lines and usually offer after-sales service. Their business model is to add margins to product prices. Distributor margins are generally higher than agent fees because distributors have costs associated with carrying inventory, marketing and extending credit for customers.

Choosing an agent or distributor: Whether using an agent or distributor, building a close working relationship is essential. Due diligence when selecting an agent or distributor is important. Companies should ask for trade references and seek a credit check through a professional agency. It is best to meet any potential agents or distributors in China. This gives them an opportunity to demonstrate knowledge of the market and to build a business relationship.

To navigate the complexities of the Chinese market, many Australian businesses benefit from working with invested distributors. It is important to conduct thorough due diligence before selecting a distributor. Time in market is an important consideration when choosing a distributor in China. As distributors have a high rate of closure, engaging an established distribution business reduces the risk of disruption to a business relationship. On the other hand, established distributors can lack the dynamism of younger companies.

When choosing an agent or distributor, do they…?

- Demonstrate an understanding of the products and prices of your competitors?

- Have a depth of experience in your sector and sub-sector?

- Have a depth of knowledge of the local market and sub-market?

- Demonstrate an understanding of consumer / customer trends?

- Have access to sales and / or marketing channels most relevant for your product?

C. Online sales

By early 2025, China had 1.87 billion active cellular mobile connections, a penetration rate of 132 per cent. The number of mobile connections increased by 108 million between the start of 2024 and the beginning of 2025. Additionally, 78 per cent of its population is now online. China has extensive network infrastructure across the country and internet speeds that reach up to 1,000 Mbps.

China’s digital network underpins the growing popularity of online shopping. Already, more than 80 per cent of the population shops online, and 37 per cent of all retail purchasing is done via e-commerce. The country has become the world’s largest e-commerce market. It is set to grow further as rural areas are connected into the market through improved infrastructure and logistics. E-commerce in China is forecast to grow to AUD 5.4 trillion (CNY 25.4 trillion) by 2028.

Accessing digital consumers: The number of internet users in China has grown rapidly and so has their time spent online. On an average, Chinese internet users spend an average of 5 hours 35 minutes online daily, with over 80 per cent either shopping, participating in auctions or using classifieds apps.

International businesses increasingly sell products to Chinese consumers via cross-border e-commerce. In response to government policies streamlining administration and offering preferential tax treatment, Chinese cross-border e-commerce volumes grew by 14 per cent y-o-y to reach CNY 2.71 trillion (AUD 579 billion) in 2024 . China does not charge import tariffs and offers reduced value-added tax rates on online transactions below CNY 5,000 (AUD 1,069), or on annual transaction volumes under CNY 26,000 (AUD 5,559).

When selling directly to digital consumers in China, businesses have few administrative requirements and do not require a legal presence in the country. Additionally, Chinese e-commerce selling platforms can provide support with paperwork and customs processes.

Top products categories for online sales in China in 2025 were, food and fashion as well as DIY and hardware products. Australian businesses can expect online sales to continue growing as more Chinese people shop online for a broader variety of goods. Whichever model you choose to enter China you must have an online pricing and sales strategy in place in this highly digital market.

Figure 2: E-commerce spending on consumer goods (2025), % of total spending

Social media: By 2024 China had the world’s highest proportion of social media users at 1.08 billion. The most popular social media platforms are Weixin (WeChat) with 91.8 per cent of internet users, Douyin (the sister app to TikTok) at 83 per cent, QQ at 63.4 per cent and Baidu Tieba with 60.2 per cent of users. Xiaohongshu, or ‘Little Red Book, is known as the ‘Instagram’ of China. Its users are mostly women from high-tier cities.

Social media is an important marketing and sales channel for businesses to connect with both end consumers and potential distribution partners. A strong and credible social-media presence is now essential for brand relevance in China. Chinese consumers place real weight on what they can see and verify online. Brands that aren’t active on major platforms risk appearing less visible — and less trustworthy — in a highly digital market.

Cross-border e-commerce sales can be explored before deciding to scale up distribution in China. 29 per cent of Chinese users discover new products on social media. Social commerce, which combines social media and e-commerce via livestreams and sales campaigns, is becoming increasingly popular. The social commerce market in China experienced robust growth during 2021-2024 and is expected to reach AUD 829 billion in 2025. By the end of 2030, the social commerce sector is projected to expand to approximately AUD 1.2 trillion.

Search engines: Baidu is the dominant search engine in China, followed by Bing. Other key search engines, but with significantly smaller market shares, include Haosou, Yandex, Google and Sogou. A quarter of Chinese consumers use the internet to do research on products and brands.

Figure 3: China’s thriving digital economy can offer compelling opportunities for Australian businesses who learn to navigate the local ecosystem.

Online sellers and marketplaces: China has multiple large online marketplaces. The market leaders are Douyin (China’s version of Tik Tok), Taobao and Tmall, both owned by Alibaba, Xiaohongshu, JD.com and Pinduoduo. Smaller players include Gome, Dianping, Suning, Moguije and Jumei

Investing in China

Investment environment

In 2023, foreign investment into China stood at its lowest level in 30 years. China’s FDI picture in the opening four months of 2025 offers a study in contrasts. On the one hand, the country continued to draw significant foreign interest, registering 18,832 new foreign‑invested enterprises. On the other hand, the total actual use of foreign capital eased, down 10.9 percent year‑on‑year, amid global economic uncertainty. Australian investment into China declined at an average annual rate of -7.5 per cent between 2019 and 2024, making China Australia’s 12th-largest outward investment destination. The decline reflects China’s slowing growth and the impact of political and trade tensions in the Pacific. In addition, foreign investors face difficulties conducting due diligence on investee companies. Some consulting firms conducting due diligence in China have been subject to increased scrutiny and raids by Chinese authorities.

The China (International) Investment Promotion Agency (CIPA) seeks to attract investment into the country and supports Chinese investment overseas. It also promotes investment in the various industrial parks and technological development zones.

The Chinese government offers a range of business incentives to encourage foreign investment into the country.

- Subsidies for foreign investment in select regions: Guangdong’s provincial government offers grants of AUD 32 million (CNY 149.6 million) to foreign invested enterprises (FIE) investing more than AUD 76.3 million (CNY 358 million). As well as offsetting an additional three per cent of their total investment in high-tech manufacturing.

- Liberalisation of ownership in value-added telecommunication services: The Ministry of Industry and Information Technology (MIIT) increased the foreignownership permitted in value-added telecommunication services in Beijing, Shanghai, Hainan and Shenzhen, to 100 per cent up from a 50 per cent cap. Additionally, foreign-invested telecommunication companies will be treated at par with domestic enterprises.

- Expansion of sectors open to investment: In 2022, China’s National Development and Reform Commission (NDRC) increased the number of manufacturing activities open to foreign investors including component manufacture in autonomous driving, advanced manufacturing as well as in the energy saving and environmental protection sectors.

Investment rules and regulations

Regulatory complexity and caps on foreign ownership in some sectors make China a challenging investment market. Mandatory technology transfer requirements designed to bolster the country’s self-sufficiency can be prohibitive to foreign investors.

China maintains a “negative list” restricting foreign investment in certain sectors. Investment is prohibited in tobacco wholesale, stem cell and genetic treatments as well as film and television production. Investment is permitted, but limited and subject to government approval, in automobile manufacturing, energy, banks and financial institutions, agriculture, transportation and utilities. This list is not exhaustive and foreign investment may be curtailed in other sectors as well.

China also promotes an “encouraged list” of sectors it wishes to attract greater foreign investment into, including cotton production, oil exploration, aquaculture and viticulture. Incentives for investments in these sectors include tax cuts, duty-free import of equipment and rent relief.

In recent years the government has taken steps to open new sectors to foreign investment, particularly in research, technology, green energy and power trading. In addition, the Chinese authorities aim to level the playing field between domestic and foreign invested enterprises in relation to procurement and cross-border data transfers. The Foreign Investment Law, which came into effect in 2020, streamlined the process for setting up joint ventures and establishing business entities in China.

The key government agencies that oversee FDI and related matters in China are the NDRC, the Ministry of Commerce (MOFCOM) and the State Administration for Market Regulation (SAMR).

Market entry models for investing

Choosing an appropriate market entry model is essential for businesses looking to invest in China. A business’ size, sector and growth strategy will help determine which market entry model fits best. Investment models frequently evolve over time as businesses enter and expand in a market. Seek professional advice on the best structure for your business.

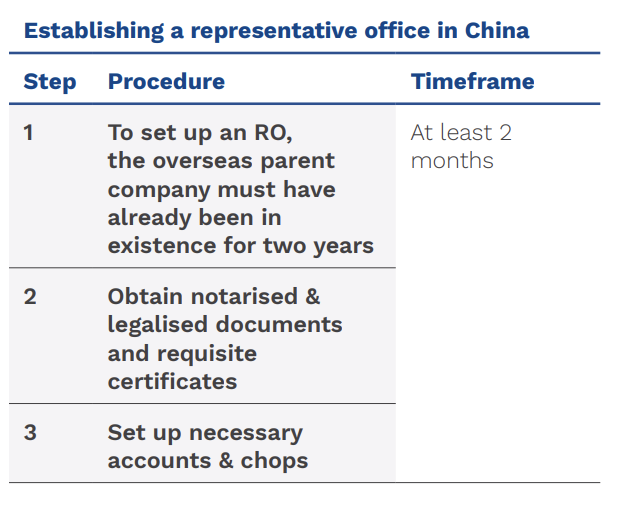

A. Representative office

Establishing a representative office (RO) in China can be an economical initial step for foreign companies looking to explore business opportunities in the region. ROs are easy to set up and enable foreign companies to utilise teams on the ground in China. An RO does not have independent legal status and as such, any contract signed by the RO is considered a contract signed directly with the foreign company.

ROs are restricted in the scope of activities they can undertake in China. They cannot directly engage in profit-making and are restricted to performing market research, advertising and publicity. ROs can only employ staff locally through qualified labour dispatch agencies. Although ROs do not earn revenue, they are liable to pay tax in China.

B. Wholly Foreign Owned Enterprise

A Wholly Foreign Owned Enterprise (WFOE) is entirely owned by one or more foreign investors and is registered as a limited liability company. WFOEs are permitted to engage in direct business activities in China and to issue invoices in the local currency (CNY).

WFOEs are the preferred approach for companies eager to ensure their intellectual property and technology are protected as they do not require the participation of a local partner. Foreign companies should plan for higher ongoing compliance overheads than in the past. Prepare to comply with local personnel requirements. For example, the roles of supervisor and director cannot be held by the same person, and the Financial Officer must be a Chinese citizen.

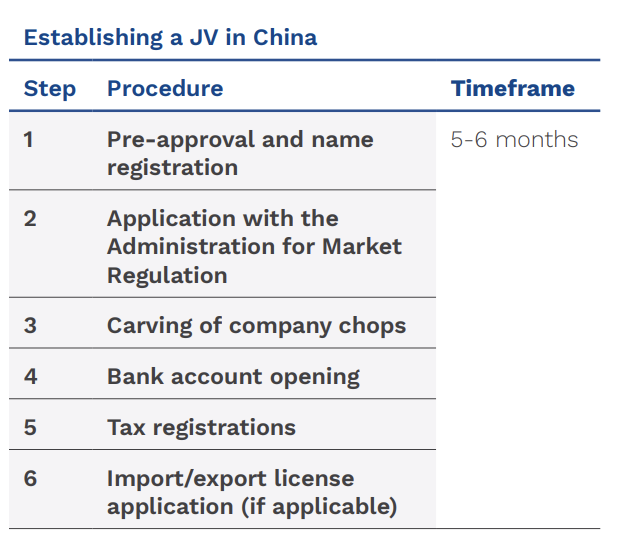

C. Joint Venture

Foreign companies can set up a joint venture (JV) with Chinese partners. This structure is beneficial for businesses looking to invest in restricted sectors. A local Chinese partner can provide knowledge and contacts as well as help business partners to navigate China’s complex regulatory environment.

JVs offer several benefits but setting them up can be a cumbersome process. While there is no compulsory minimum registered capital for a JV, changes to the Company Law in 2023 require shareholders to fulfil their capital subscription obligations within five years of a company’s inception.

D. Franchising

Franchising allows business owners to retain a measure of control while harnessing the energy of franchisees to drive expansion. Franchises project a company’s reputation and brand, and while it can be expensive, building a network of franchises is generally cheaper than owning and operating retail or branch offices in foreign markets.

China’s large population and shift towards a consumer economy offer an attractive opportunity for franchisors. Rules and regulations around franchising have been clarified in recent years, making it an attractive approach to the Chinese market. Foreign businesses are now permitted to operate businesses without the need to create a Chinese legal entity. Franchising is a popular model for Australian brands looking to sell goods and services in China, particularly in food and beverage, retail and business services.

Franchising in China must fulfil the requirements set out by the Commercial Franchise Administration Regulations Ordinance No. 485 of 31 January 2007. A franchise must contain three elements: a) the franchisor grants operators the right to use the franchisor’s resources’ b) franchisees must conduct business under a uniform mode of operation; and c) franchise fees must be paid to the franchisees as per the agreement. Additionally, businesses must also adhere to the franchising regulations, namely the Commercial Franchise Record Filing Administrative Measures, Ministry of Commerce Decree No. 5 of 2011 and the Commercial Franchise Information Disclosure Administrative Measures, Decree No. 2 of 2012.

Australian businesses seeking an entry via franchising should conduct research, assess the IP legislation, conduct due diligence and seek local resources to ensure compliance and mitigate risks.

Go to market strategy

Success in China’s large complex market requires businesses to tailor their product or service to the market. This should be based on detailed analysis of consumer trends, price consciousness, branding, marketing and advertising, and payment methods.

Five decades of growth have resulted in substantial per capita income increases for the 500 million members of China’s middle class. Rapid income growth and fast-changing consumer preferences make this a dynamic market. Despite the slowing of China’s economic growth in recent years, its middle class is expected to continue expanding, facilitating spending on discretionary products and services. Rising prices have subdued consumer sentiment but demand will continue to drive spending on education, food and beverages, travel and healthcare.

In 2024, China’s per capita disposable income reached AUD 8,833 (CNY 41,314), growing 5.3 per cent yearon-year. For Australian businesses looking to enter the Chinese market, understanding the behaviours, aspirations and spending patterns of this emerging consumer group is essential.

Price consciousness

While Chinese per capita incomes increased at a rate of 5.1 per cent in 2025, the cost of living continued to increase also. More than half of Chinese consumers site concerns about rising prices.

COVID-19 heavily influenced consumption patterns in China. Despite efforts to restore consumer confidence, the country is estimated to require an additional AUD 641 billion (CNY 3 trillion) in public investment to restore consumption to pre-pandemic levels. However, China’s consumer confidence remains higher than many advanced economies such German, Japan and the United Kingdom.

Branding

Branding is as critical in China as in any market, and companies need to research and understand the specific tastes of consumers to achieve success. A failure to respond to changing trends and consumer preferences could result in conceding market share to local brands that respond quickly to changing consumer preferences.

Investing time in understanding consumer preferences and the evolving competitive landscape will enable Australian businesses to position their products to compete with local rivals. Although, gaining access to consumer data can be challenging in China where laws restrict the collection, storage and transfer of data.

Chinese consumers are increasingly willing to spend more on better quality products across many categories. Brand name and prestige are important in the market. Australian businesses in some sectors enjoy a branding advantage. Australian products have a strong reputation for high quality and safety standards, particularly in health, wellness and beauty. An emphasis on Australian origin can also be a marketing asset in the food and beverage and agricultural sectors.

Austrade’s Nation Brand toolkit provides a range of free branding assets for businesses looking to export.

Marketing

International trade shows are popular in China. Between 2024-2025 China hosted more than 500 trade shows in sectors such as transport and logistics, renewable energy, power, food and agribusiness and education. Trade shows, such as the China International Import Expo (CIIE), provide an effective starting point for businesses to gauge reception to their products or services and can be a useful platform for finding local partners. Australian federal and state trade agencies often organise delegations to these trade shows.

Paid online search campaigns through online platforms such as Baidu and social media services including Weibo, WeChat, Little Red Book and Douyin can be effective in China Marketing campaigns and sales promotions during major festivals, such as the 520, China’s equivalent of Valentine’s Day, are a good way to reach target audiences.

Localising marketing efforts is important in China. Chinese consumers and team members in the Australian community can be a helpful source for gaining insights and refining approaches for Chinese audiences. Foreign marketing campaigns should consider local expressions and cultural references when the content is translated for Chinese audiences. False or misleading marketing is a serious issue in the country, especially in relation to health, property, safety and social media offerings. Foreign businesses are encouraged to work with trusted marketing firms and Chinese consumers in the Australian community to gain insights as well as to navigate the regulatory landscape and to develop effective strategies tailored to Chinese consumer preferences.

Advertising and media

China’s wide internet and e-commerce penetration make digital advertising an essential business strategy. In 2024, digital advertising expenditure stood at AUD 303 billion (CNY 1.42 trillion), of which 31.5 per cent was dedicated to online search.

Social media and influencer marketing strategies also drive sales in China. Livestream shopping, combining live video broadcasts and real-time customer interactions, is gaining in popularity. These live-stream promotions can be hosted outside of China, often at locations that aim to grab the attention of Chinese consumers, such as popular tourist destinations and flagship retail stores. Chinese sellers are also experimenting with innovative technologies such as virtual hosts and digital avatars.

Advertising in China is subject to strict regulation, with both national and provincial governments exercising control over content. The Advertising Law prohibits online advertising to internet users without their prior consent, it also requires popup adverts be easily closed with one click and that unsubscribing be made easy.

Figure 5: Digital advertising audiences in China (2025)

Digital payments

Rapid digitalisation, deep mobile internet penetration, and the integration of digital payments into social networks have made China a global leader in digital payments. In 2024, the value of electronic payment transactions was AUD 732.5 trillion (CNY 3427 trillion). Today, the country is largely cashless, with more than 80 per cent of daily consumer transactions conducted via mobile platforms. Most payments are made by tapping smartphones or scanning QR codes. The payment market is dominated by Alipay, We Chat Pay and UnionPay.

China is piloting the use of the e-CNY, or ‘digital yuan, a central bank digital currency. Uptake has been rapid. To July 2024 the digital currency saw transactions totalling AUD 1.5 trillion (CNY 7 trillion). China is also developing a multi- central bank digital currency program to facilitate real-time, cheap, secure and efficient cross-border payments and settlements.

Figure 6: Payment methods for B2C e-commerce (2025), %

Developing your market entry strategy

A well-considered market entry strategy should take a systematic approach that supports long-term success. This section summarises the factors businesses should consider when formulating an approach to the Chinese market into a series of key questions.

Asialink Business provides advisory services and capability training programs to help organisations understand and access opportunities in Asian markets. Should you have questions about any aspect of your China market entry strategy, please contact us. Austrade has several offices in China that provide services and support to Australian businesses with an interest in China (details can be found here).

Calibrating Ambition

- What is your company’s aspiration for the market?

- What are the challenges and risks you will need to mitigate?

Consumers

- What is the current or potential demand for your product or service in China?

- Who are the primary customers / consumers for your product or service in the market?

- How will you tailor your product or service to local preferences?

Competitors

- Who are your competitors in the market, and what is their offering?

- How does your product or service compare to competitors on price?

Sales, Brand and Marketing

- What is your unique value proposition for the market?

- What is the ideal mix of marketing and sales channels to reach your target customers?

- Is your marketing strategy aligned with your identified consumer base and value proposition?

Mode of Entry

- What is the right market entry model for your business?

- What are the specific geographies you should target?

Delivery Partners

- Does your team have the right mix of skills and expertise to support your market entry?

- What partnerships will contribute to your business’ success in the market?

- What external advice do you need to commission?

Operating Model

- What changes do you need to make to your business across areas such as operations, HR, finance and IT?