Costs of doing business in China

Understanding the additional costs associated with conducting business overseas is essential to making an informed decision on whether you are ready to take the plunge. The main differences in China compared with operating in Australia may include:

- A longer cash flow cycle, which could increase the pressure on cash flow and working capital

- Being further away from clients, this can increase the risk of non-payment and make it more difficult to collect debts

- Risk of non-payment in China is generally higher than other countries in Asia, even if you have a presence there

- Getting paid in other currencies, which can expose you to foreign exchange risk and affect profit margins

- Greater difficulty accessing finance, as Australian banks are often reluctant to accept overseas assets as security for loans

- A longer timeframe to recover the upfront costs of establishing operations, which can reduce the cash flow and working capital available for domestic operations.

Adequate funding will be critical to your success, and a detailed financial plan is crucial. Your financing options could vary according to whether you are exporting, importing or investing. A wide range of funding options exists, with various grants, venture capital and equity sharing deals increasingly commonplace. However, banks remain the easiest and most approachable source of funding, with most of them offering tailored services. Your existing bank manager may be your best first port of call.

Venture Capital

Venture capital could be an attractive alternative financing vehicle if you are comfortable with a third party taking an equity stake – and a share of the profits – in your business. As a first step to research the venture capital market, go to the Australian Private Equity and Venture Capital Association Limited website at www.avcal.com.au.

Government Assistance

Government assistance – both federal and state – is available to Australian businesses wanting to expand overseas, especially exporters, through a number of grants, loan facilities and reimbursement schemes. These include Export Finance Insurance Corporation (Efic) – the Australian government’s export credit agency (go to www.efic.gov.au) and the Export Market Development Grants (EMDG) scheme, administered by Austrade. Full information can be found at www.austrade.gov.au/EMDG.

Individual state and territory government websites also contain information on what financial assistance they can offer. Other sources of finance you could consider early on include:

- A joint venture arrangement with a trusted partner in China

- Receiving an equity investment from a sophisticated individual investor or ‘angel investor’.

Taxation

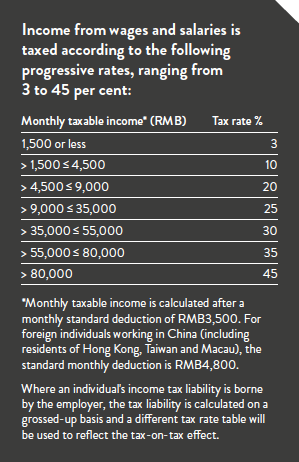

China’s taxation system includes a wide range of imposts on businesses and individuals including income taxes (corporate income tax and individual income tax), turnover taxes (value added tax, business tax and consumption tax), taxes on property (land appreciation tax and real estate tax), as well as taxes such as stamp tax, customs duties, motor vehicle acquisition tax, vehicle and vessel tax, and urban construction and maintenance tax.

It is important that Australian businesses seek professional advice to discuss the various taxes that may apply to their business and its specific situation. China’s laws and regulations, which underpin the nation’s tax system, are currently in a state of transition and discussion drafts looking at various aspects, including the Taxation Collection Administration Law (TCAL), and the VAT and Business Tax systems.

Tax laws and policies are developed jointly by the regulatory bodies of the State Administration of Taxation (SAT) and the Ministry of Finance. The SAT is the body charged with collecting tax and enforcing compliance and is assisted by the state and local tax bureaus at the provincial level and below. Applicable tax laws and policies will vary depending on the city and province in which a business is operating as there can be additional local surcharges that may apply based on provincial tax regulations.

For an overview of the primary taxes Australian enterprises need to consider when establishing a business in China, see taxation.

Want to learn more? Explore our other China information categories or download the China Country Starter Pack.